-

What services do you offer?

Wisdom Index provides financial planning services, portfolio management for individuals, small businesses and institutional clients. We act as a fiduciary and eliminate conflicts of interest in our commitment to help you Walk in Wisdom®.

-

What are your areas of expertise?

We work with clients in all areas of financial planning and investment management. This includes cash flow and budgeting, college planning, retirement, disability, long-term care and life insurance analysis, and estate planning. We partner with local CPAs, insurance agents, and estate planning attorneys to ensure that all aspects of your financial plan are accounted for.

-

Can you work with people in any state?

Absolutely! We are an SEC registered firm with clients in 19 states. Our home office is in Prosper, TX, but technological advancements in web meetings allows us to meet with clients all over the country.

-

What is the Discovery Process?

The Discovery Process is our outline of steps to begin your Walk in Wisdom®. First, we want to have a meaningful and intentional introductory meeting where we provide a detailed firm overview. In this first meeting, we also ask a series of questions to understand your visions, values, goals, and key relationships. The second step in the Discovery Process is a portfolio and plan review. After looking at your finances and goals, we will create an income statement and balance sheet. At the conclusion of this meeting, we will create a draft Wisdom Index® and goal calculations with our Wisdom Increase recommendations. Lastly, if you agree with our investment philosophy and value our integration of Wisdom Principles in financial planning, then you can hire us to provide comprehensive planning and wealth management services.

-

If I hire you, what should I expect?

If, at the end of the Discovery Process, you decide to hire us, then you should have several expectations. We will provide on-going and flexible advice that adjusts to your current life events and financial goals. Additionally, we provide continuous portfolio management and rebalances to make sure all accounts are allocated according to the target allocation. Lastly, we developed a client interaction calendar that helps us communicate important topics and action items throughout the year.

-

How are your services priced?

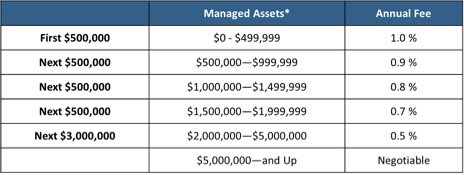

Fees are calculated upon the following tiered and blended annual schedule but may be negotiated on a case-by-case basis. Fees are based on total Assets Under Management (AUM) for each client. We are fee-only, meaning that we do not receive any compensation or extra incentives from our partners.